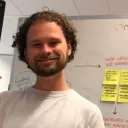

Discovery from End-to-End

Product discovery is usually an on-going process, where a team is constantly learning new things and using this to improve the product. But when a vision changes, or when tech debt has been building up, more extensive research is needed to compensate, just like developers need time to refactor spaghetti code. At the start of my three years on this product, I found myself in a situation where proper documentation was lacking and usability was extremely poor for internal users. To get a head start on improving the usability, I began with documenting persona’s, journeys, applications, and market trends. This documentation proved to be very useful later when adding new redesigning or adding functionality, and was kept up to date with new insights found during continuous discovery.

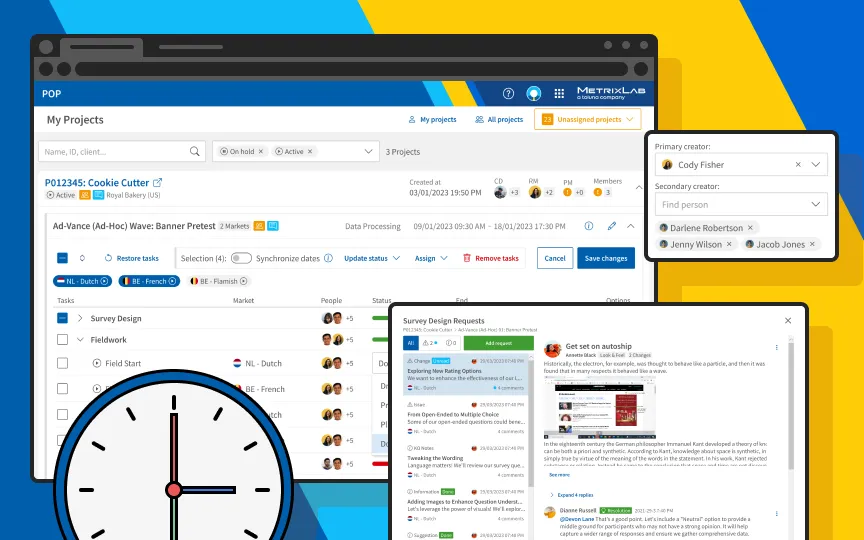

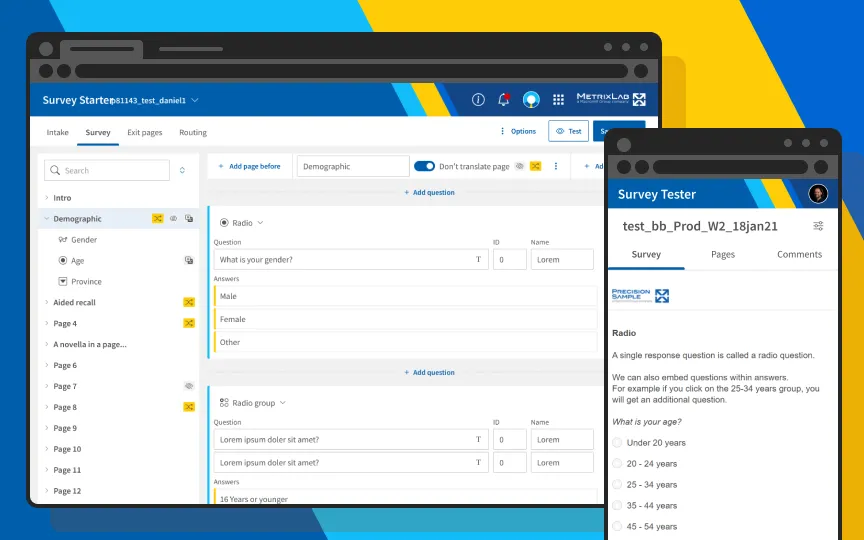

The digital marketresearch process

Online marketresearch is a process that is remarkably similar throughout the industry. The journey usually starts with the sales process, where the availability and costs of respondents is retrieved. When the project is sold, complex surveys are created with in-context research methods, like social media platform simulations for ads, and store shelves for packaging. These surveys are usually templated, but often require advanced customizations based on client needs. While the surveys are live, response rates need to be monitored constantly to see if quotas are being filled and demographics are kept in balance. And when the data is in, it needs to be processed into KPI’s for reporting. The ultimate step is to create visualizations that provide insight and tell a compelling story.

Personas

The IT department responsible for maintaining the software was separated into different domains, with each domain led by a product owner. I asked all product owners to contribute to a list of distinct types of users in their domain. After the list had been completed, I hosted a session with the product owner team where I guided them to create proto-personas with demographics, goals, and frustrations. The full list consisted of over 15 personas, which were updated and extended with various levels of seniority over the next 3 years. The main personas are listed below.

- Client Director - Manages client accounts and relationships by selling research and keeping taps on delivery and reporting.

- Research (Process) Manager - Creates the projects and schedules, gives instructions, and answers questions.

- Project Manager - Updates the schedules with planned and actual dates, makes sure tasks are delivered on time.

- Operations team - Specialists taking care of sample sourcing, survey programming, field management, data processing, data visualizations and advanced analysis.

Journey Mapping

After identifying personas, I continued with mapping the full research process based on input from expert stakeholders, and quickly found out there were many smaller steps and roles involved in this process. Steps can be skipped or added when they are required. Some marketresearch projects follow a template and can be completed within a few days. Other projects are extremely customized and take much longer, or they are even repeated over time. However, the main process is still lineair with a definite start and end. I documented the process in Figma and shared it with stakeholders many times.

Full visualization of the user journey in flowcharts, split by phases, steps, and persona's

Full visualization of the user journey in flowcharts, split by phases, steps, and persona's

Focus Groups

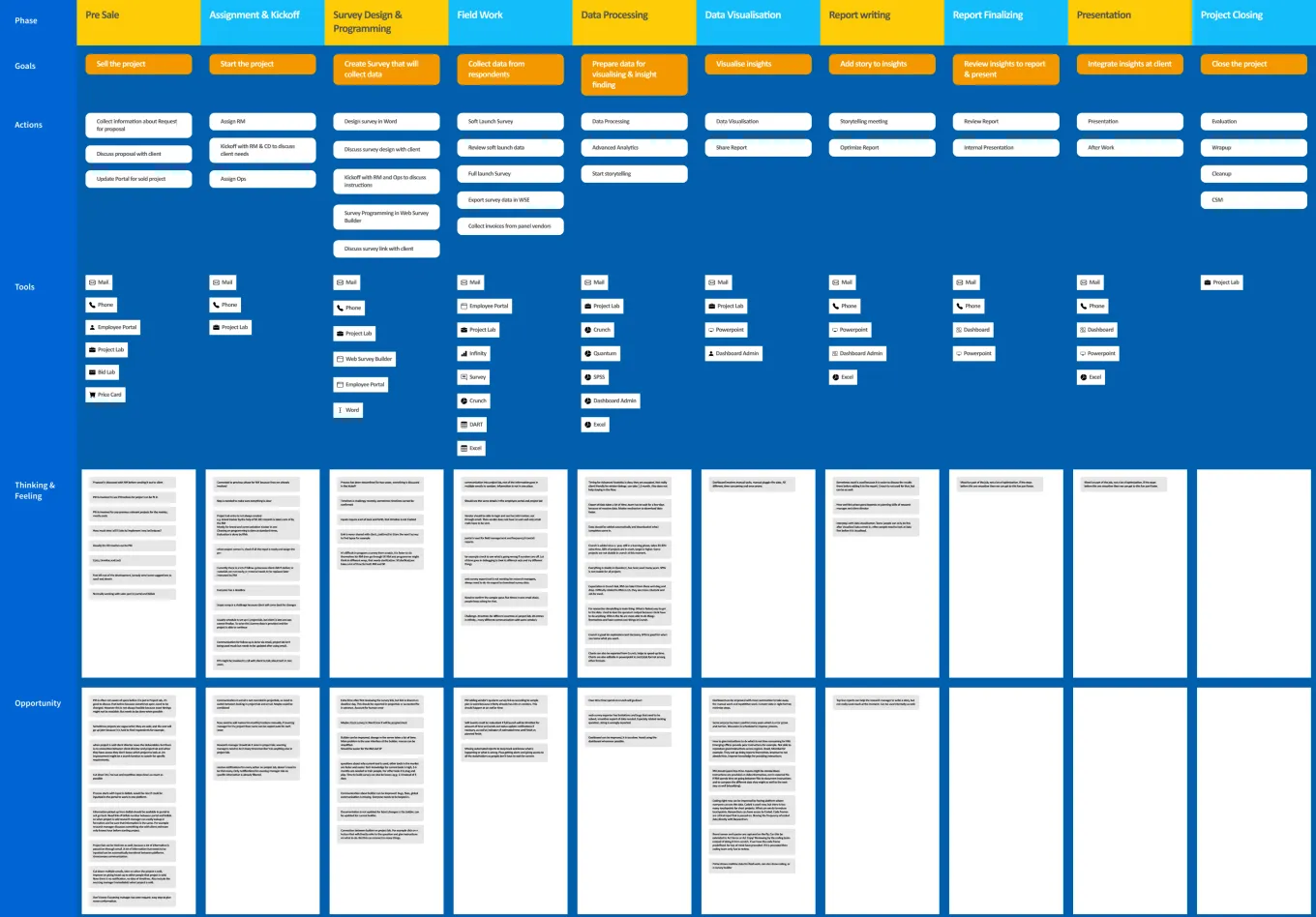

To get input from users of the system, I hosted focus groups where the process was discussed with distinct types of users. I guided the discussion by creating a journey template already filled with phases, goals, steps, and tools. During the discussion, I asked participants to add more actions and tools, and to share thoughts, feelings, and opportunities. These sessions where remotely hosted on Microsoft Teams because of the pandemic and global distribution of the company. Even remote, the sessions still provided extremely useful insights:

- Cut down all the manual and repetitive steps as much as possible.

- Input information during the process in one platform, including email communication.

- Reduce the amount of email notifications to only those that are relevant.

A point-and-talk exercise used in focus groups: The user journey with goals, steps and tools, with open space for notes and ideas

A point-and-talk exercise used in focus groups: The user journey with goals, steps and tools, with open space for notes and ideas

Software and Design System Audits

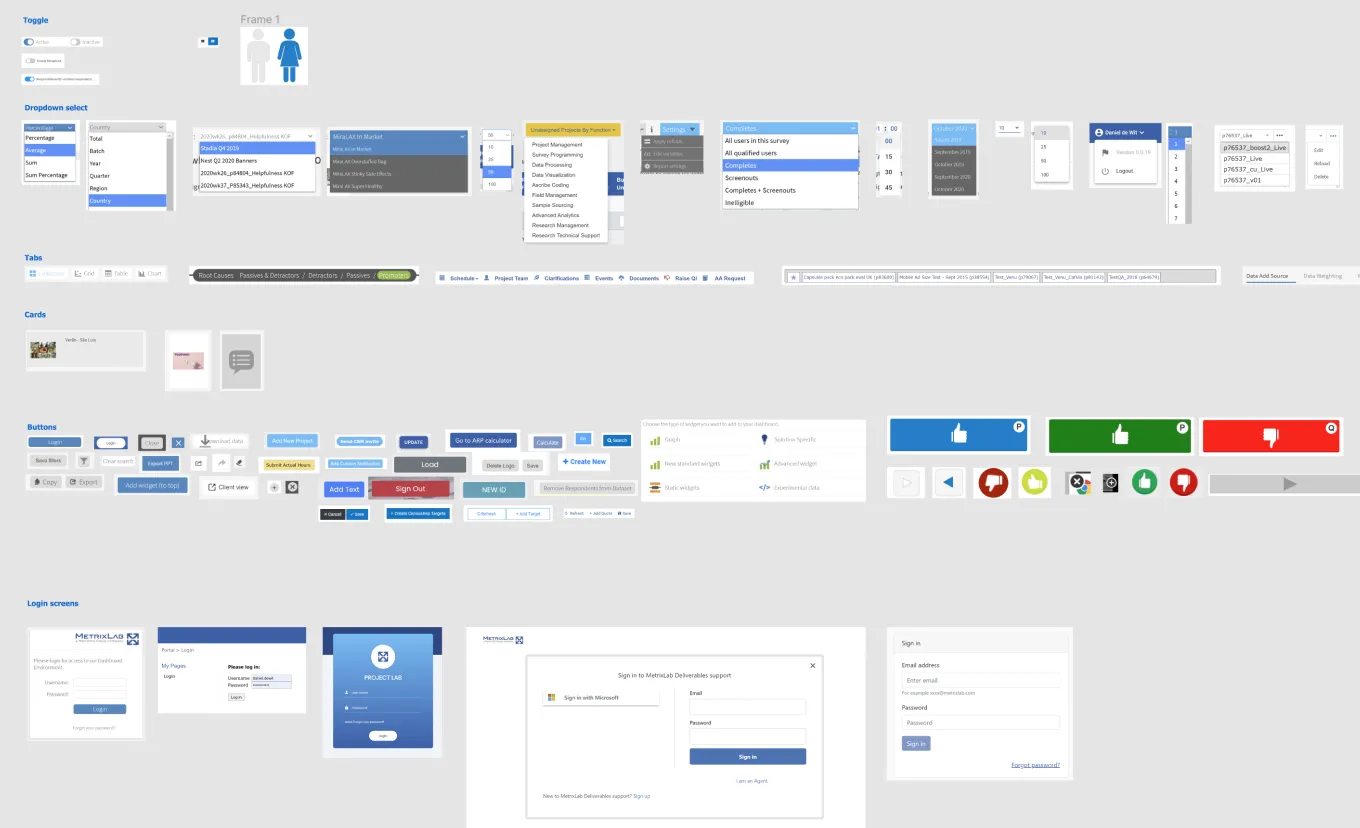

As part of better understanding the legacy systems, I made software audits by listening in on demo sessions and clicking through demo accounts. During these activities, I captured screenshots and made flow visualizations to document the functionality, information architecture, and interface elements of the legacy software. By immersing myself in this hands-on process, I gained firsthand insights into the intricacies of the system, understanding its strengths and limitations. Additionally I made screenshots of inconsistent component instances used in the platform and categorized them. I got other designers to contribute in collecting screenshots as well.

The captured visual records provided a comprehensive reference point, serving as a crucial resource for subsequent redesign efforts. This approach allowed me to strategize and implement improvements tailored to both user needs and the constraints of existing software. The software had to be replaced piece-by-piece without compromising on-going business operations. For our design system, it also helped people understand the need for a design system and it helped me in creating and prioritizing a component backlog.

Documentation of inconsistent components, screenshotted and categorized

Documentation of inconsistent components, screenshotted and categorized

Market Analysis

In my role as a design team manager, a significant annual undertaking involved a thorough analysis and comparison of do-it-yourself (DIY) marketresearch tools created and published by competitors. I assigned members of my team to delve into the intricate details of competitors' interaction flows, dissecting the user experience at every juncture. Through examination, we created comprehensive SWOT analyses, precisely outlining the strengths and weaknesses of competitors' tools. The focus was not only on understanding the landscape but also on identifying gaps relative to our software. These analyses became valuable strategic assets, offering insights into areas of potential improvement within our own platform. By adopting a proactive approach as a UX/UI team, we not only kept an eye on industry trends to follow but also aimed at continuous enhancement, ensuring our software remained innovative in meeting user needs. In addition to informing our own design iterations, we shared these analyses collaboratively with product owners. This exchange facilitated a constructive dialogue, inspiring the conceptualization of new features and contributing to strategic roadmap planning.